17th August 2020 | DAILY WISDOM TEST-THE PT QUEST 2020

DAILY WISDOM TEST-THE PT QUEST 2020

Date:- (17-08-2020)

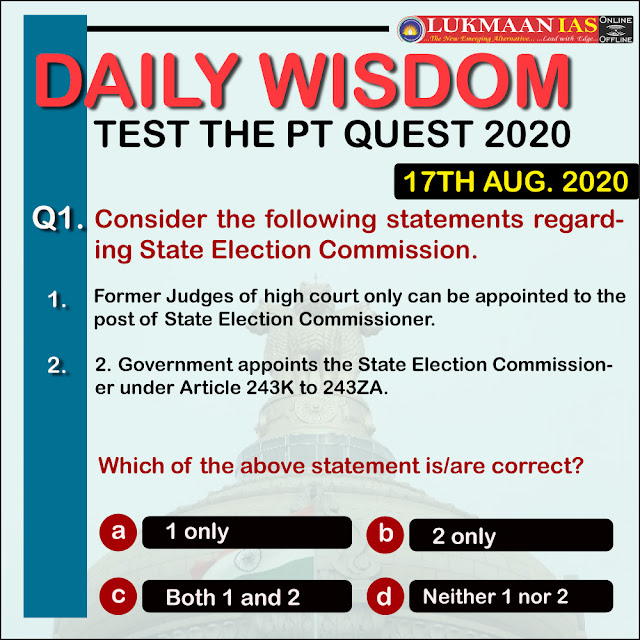

Question-1

The correct Answers is

ANSWER: D

Explanation:

The question is based on the recent case of removal of state High

Commissioner by the Andhra Pradesh government through an ordinance

amending the Panchayati Raj Act. The High Court while setting aside the

amendment, commented that the power to appoint State Election

Commissioner rests only with Governor and not the Government under

Article 243K to 243ZA. Also, Bureaucrats can be considered for the post

of State Election Commissioner.

Question-2

The correct Answers is

ANSWER: D

Explanation: The question pertains to the recent RTI Amendment Act along with the basics of RTI. Public authorities under the RTI Act includes the bodies of self-government established under the Constitution, law or government notification. It also includes Ministries, Public sector undertakings, regulators along with NGOs and entities owned, controlled or substantially financed by the government. Secondly, CIC and IC used to hold office for a term of five years but with the RTI Amendment Act, 2019, this provision has been removed and thus terms of office is notified by the government. Lastly, an appellate body has been created under the RTI Act.

ANSWER: D

Explanation: The question pertains to the recent RTI Amendment Act along with the basics of RTI. Public authorities under the RTI Act includes the bodies of self-government established under the Constitution, law or government notification. It also includes Ministries, Public sector undertakings, regulators along with NGOs and entities owned, controlled or substantially financed by the government. Secondly, CIC and IC used to hold office for a term of five years but with the RTI Amendment Act, 2019, this provision has been removed and thus terms of office is notified by the government. Lastly, an appellate body has been created under the RTI Act.

Question-3

The correct Answers is

ANSWER: C

Explanation: Finance Bill category I can be introduced only on the prior recommendation of the President while Finance Bill category II need President recommendation for consideration of the Bill i.e. just before voting. Till date, the decision of the Speaker with respect to Money Bill is final, However, the Supreme Court has referred the question to a larger bench to discuss the issue.

ANSWER: C

Explanation: Finance Bill category I can be introduced only on the prior recommendation of the President while Finance Bill category II need President recommendation for consideration of the Bill i.e. just before voting. Till date, the decision of the Speaker with respect to Money Bill is final, However, the Supreme Court has referred the question to a larger bench to discuss the issue.

Question-4

The correct Answers is

ANSWER: C

Explanation : The Act empowers State/UT government to make special measures and formulate regulations for containing the outbreak. It gives legal protection to the implementing authority under the Act. Bal Gangadhar Tilak was punished under it for his Articles in Kesari regarding the handling of Bubonic Plague by the British.

ANSWER: C

Explanation : The Act empowers State/UT government to make special measures and formulate regulations for containing the outbreak. It gives legal protection to the implementing authority under the Act. Bal Gangadhar Tilak was punished under it for his Articles in Kesari regarding the handling of Bubonic Plague by the British.

Question-5

The correct Answers is

ANSWER: A

Explanation : Taxation subjects have been divided between Union and State list. However, with the introduction of GST Act, GST became the first taxation related subject to be introduced into the Concurrent list. President is empowered to make necessary changes to remove any difficulty in GST implementation. The term of Vice-chairperson of GST Council is decided by the Council itself and is not mentioned in the Act.

ANSWER: A

Explanation : Taxation subjects have been divided between Union and State list. However, with the introduction of GST Act, GST became the first taxation related subject to be introduced into the Concurrent list. President is empowered to make necessary changes to remove any difficulty in GST implementation. The term of Vice-chairperson of GST Council is decided by the Council itself and is not mentioned in the Act.

Comments

Post a Comment